Source: Forbes

Last summer’s drought in the US Midwest reminded us all just how vulnerable harvests and commodity prices can be to adverse or extreme weather events. That, along with crop failures in Russia and, more recently, the UK, has helped to turn prices that once served as ceilings into floors for commodities like wheat and corn in the last two years.

As Turner Investments, a money management firm, points out in a new report, this is important to investors not just because of what it means for commodity prices but because it has ramifications for the ability of farmers to deliver the harvests needed to sustain the world’s growing population. In turn, that shines a spotlight on companies that are engaged in what Turner describes as “precision agriculture”: the business of making farms more “exact and productive”, using everything from database management and global-positioning satellites to boost productivity and cut costs for farmers.

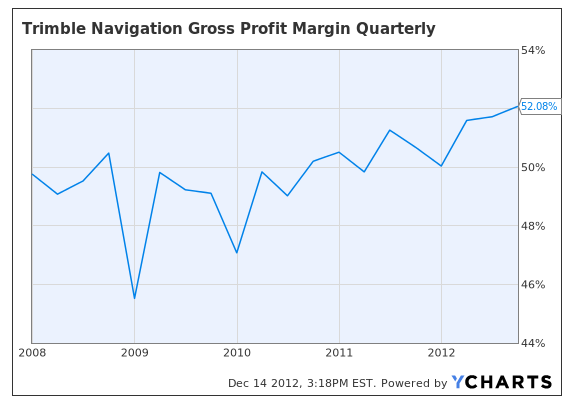

Turner identifies three companies it believes are leaders in this arena: household names Monsanto (MON) and Deere & Co. (DE), and the much lower-profile Trimble Navigation Ltd. (TRMB), which also happens to be the member of the trio that has outperformed its peers and the broader market over both a one-year and five-year time frame. (Although it only recently has seized back the leadership from the better-known Monsanto, as seen in a stock chart.

Click to Enlarge |

Click to Enlarge |

Click to Enlarge |

Analysts are nearly as bullish on the company as is Turner Investments, with eight of the ten who track the company rating it a buy; the median price target stands at $62 a share, with the high at $66, while the company’s stock current changes hands for about $58 a share. And while Monsanto and Deere are already giant global players, there are still some emerging markets – areas where agricultural productivity is even more crucial, as output shortfalls have been known to produce riots protesting the availability or high prices of foodstuffs – where the company can increase its exposure.

Farmers report that it’s made them more money, according to the Precision Ag Institute, an industry group. These farmers say they now make $5 to $9 more per acre than before, depending on the crop and region.

As Turner Investments points out, in an era when a farmer can take his iPhone into the fields and use the data it generates to customize and modify his decisions to fertilize a particular corner of a specific field, and produce crops more efficiently and profitably, the companies that enable him to do so are likely to remain out-performers.

![[Technology Corner] Discussing AI’s Potential Impact on Service & Support](https://www.precisionfarmingdealer.com/ext/resources/2025/04/11/Discussing-AIs-Potential-Impact-on-Service--Support.png?height=290&t=1744385717&width=400)