It’s been a challenging few years for many precision farming dealers navigating the instability of the commodities market and cautious purchasing habits of customers.

But the results of this year’s fifth annual Precision Farming Dealer benchmark study — with contributions from 120 farm equipment dealers, input retailers and independent precision companies — signal an optimistic shift in retailers’ revenue expectations and business objectives compared to recent years. Talking with dealers during the first part 2017, there seems to be more confidence and less concern about the current ag market.

Says one precision farming manager at a Midwest equipment dealership, “The last few years have forced us to be more creative, but they have also been our 3 most profitable years. Dealers who have been able to adapt and learn in a down market are going to be the better for it and we’re already seeing that positively reflected in our bottom line.”

While challenges remain — training voids, market saturation and crop prices — this year’s report reveals a revival of agronomic and data management-driven services, along with an emphasis on recurring revenue sources.

Revenue Rebound

During the last few years, dealers have been extremely conservative with their revenue growth projections, reflecting their customers’ more prudent purchasing habits.

But this year’s benchmark study reveals a reversal in recent revenue trends. Based on responses gathered during the first quarter of 2017 from 28 different states and Canada, 23% of dealers reported 2016 precision revenue growth of 8% or more, more than doubling their forecast (10%) from last year’s report.

On the other end of the spectrum, 8.7% of dealers reported revenue declines of 8% or more last year, about 3 points lower (11.1%) than forecast during the first quarter of 2016. This also marks the first time since the study began tracking revenue projections 3 years ago that revenue declines of 8% or more were in single digits.

It’s worth noting that 75.6% of respondents identified themselves as traditional farm equipment dealers, the lowest figure since the study began tracking business structure in 2015. Among this group, 41.8% reported 2016 revenue growth of at least 2%.

Some 16% of respondents classified themselves as independent precision dealers, with 66.7% of this group reporting at least 2% revenue growth in 2016.

Seed, chemical or fertilizer retailers participating in the study increased year-over-year, from 4 to 8.4%. Some 40% of this group reported revenue growth of 2% or more in 2016, including 30% who saw growth of 8% or more.

This year also saw an increase in 1-2 store dealerships participating in the study, from 37.6% in 2016 to a high of 48.3%. Drilling down to this group’s 2016 revenue, 41.5% reported growth of at least 2%, generally consistent with the overall total (45.2%), while another 39.6% indicated little or no change.

For dealerships with 11 or more stores, 52.9% reported 2016 revenue growth of 2% or more. But interestingly, nearly one-third reported revenue declines of at least 2%. Only 17.7% indicated little or no change to their precision revenue.

So what are retailers anticipating in 2017? Some 59.6% of all dealers forecast revenue growth of at least 2% this year, with 15.4% projecting growth of at least 8%. This is well ahead of the 40% of dealers who forecast revenue growth of at least 2% at the same time last year, along with the 41% in 2015, and is more in line with 2014 (59.2%) results.

Fewer dealers are also anticipating measurable revenue declines in 2017. Only 11.5% are forecasting a dip of 2% or more, by far the lowest total in the history of the study. Only 4.8% of dealers are projecting revenue decreases of 8% or more.

Some 28.9% of dealers forecast little or no change in their precision revenue year-over-year.

Both large (11+ stores) and 1-2 location dealerships forecast comparable growth to the overall group, with 58% from each segment projecting growth of at least 2%. Only about 11% from each group anticipate revenue declines of at least 2%.

There are more dramatic differences in revenue projections among dealerships types. Some 80% of independent precision dealers forecast revenue growth of at least 2%, compared to 58.3% for farm equipment dealers and 40% for seed and fertilizer retailers.

It’s worth noting that despite the overall optimism, there is still concern among respondents about how the ag economy could influence farmers’ willingness to invest in technology.

Says one dealer from Ohio, “Low income levels have slowed the demand for services. We need to convince customers the economic data that will be generated by technology can help them make better input decisions.”

Adds another dealer from Idaho, “Farmers are willing to keep older technology in their tractors and equipment. Trading up or upgrading is not going to be a number one priority for them this year. We are gearing up to provide exceptional service to these customers by doing more customer training and field days so we can keep their business in the years to come.”

Service Driven

While dealers are seeing revenue rebound, it’s not necessarily being driven by hardware sales. Some 48.6% of revenue — the lowest percentage in the 5 year history of the study — is coming from component sales.

Despite a small rebound last year, the percentage of revenue generated by hardware sales has dropped every year from its 62% peak in 2013. Dealers often point to market saturation and competition as contributing factors to decreasing margins on precision products.

“One of our biggest challenges is dealing with low margin competitors,” says one precision farming manager in Wisconsin. “We must hold our margins. We will not take low margin deals, so we may be out of a deal just on price.”

An alternative approach to rooting revenue in hardware is emphasizing the service side of precision. While this can be an equally competitive market, it is one which dealers have had success separating themselves from the competition.

Some 17.1% of 2017 revenue comes from ag technology service and support, nearly identical to last year’s 17.3%, but below the 22.2% total in 2015. Still, developing more recurring streams of revenue has been a focal point for dealers and another area of opportunity that bounced back in 2017 was data management services.

After dropping 3 points in 2016 to 5.3%, data management rebounded to its 2015 level of revenue in this year’s study at 8.3%. Although still a small percentage of overall revenue, there is momentum toward transitioning into more agronomic services.

“Data is the easiest way to prove ROI,” says one Wisconsin precision farming manager. “But you have to know your market.”

Increasing Independence

For the fifth consecutive year, the majority of respondents said their primary objective with precision farming is to supplement wholegoods sales. But it was also the lowest percentage — 39.5% — in the history of the study as more independent objectives gained ground.

Some 21.9% of dealers said their primary goal with their precision business is independent sales of hardware and products, up about 3 points over 2016 and 4 points over 2015. However, this is still well below the high of 28.6% in 2014.

Also on the rise for the third year in a row was independent service and support as the primary objective with precision business, with a high of 16.7%, after a previous high of 15.1% in 2016.

As was discussed at the 2017 Precision Farming Dealer Summit in St. Louis, dealers are pricing and packaging precision services to retain customers, while also leveraging support plans to attract new ones.

“We have about 165 solid customers that we deal with yearly on a face-to-face basis, so I asked some our best farmers what they thought would be fair to include in a package,” says Nathan Zimmerman, precision farming manager with A.C. McCartney in Illinois. “One of the things we realized is that we have a lot of customers who maybe only bought 1 piece of equipment or technology from us. How would we sell them a comprehensive package if we don’t really have a reason to talk to them during planting season because they don’t have a product we sold them?”

The solution was to give customers choices and essentially build their own service plans. The dealership started with a $300 base plan that includes unlimited phone support, 2 technology training classes per year, free loaner hardware and a 10% discount on technology parts and labor. Then the dealership offers discounted add-on services that customers can purchase outside of the annual service plan, including pre-season inspections ($100 per unit), yield monitor calibrations ($75 per crop) and yield map printing ($10 per field).

“In some cases, it’s a 50% discount on those additional services for customers who enroll in our annual base service plan, which has been an effective selling point,” Zimmerman says. “We rolled the plans out in 2016 and about 30% of our solid customers signed up, and at the end of the year, 15% had already renewed, so they are seeing the value.”

Aftermarket sales and service as the main precision business goal grew as well, from 17.2% in 2016 to 21.9% this year. This was still below the high of 23.4% in 2015.

While respondents have expressed concern about more farm machinery coming precision-ready from the factory, reducing aftermarket opportunities, the trend hasn’t consistently shown up in benchmark study results.

In 2013, some 53.8% of precision farming products were sold factory installed on equipment, by far the most popular method. But during the last 4 years, an average of 39.2% of precision products are being sold factory installed, including a low of 36.5% in 2017.

It makes sense that more farmers are holding onto their equipment longer during the downturn, and therefore less precision hardware is being sold installed on new equipment.

Says one dealer, “Our biggest challenge will be more aftermarket systems coming into the area at cheaper prices. We plan to deal with this situation by offering a better service deal and more customer training.”

The percentage of aftermarket precision products being sold remained consistent year-over-year, with 47.8% this year, vs. 48% in 2016. However, these are both behind 2014 and 2015 totals, which both topped 52%.

After 3 years of incremental growth, used equipment as a sales channel dipped slightly from 10% last year to 9.8% in 2017.

Attention on Agronomics

A consistent trend throughout this year’s benchmark study results is an increase in activity by dealers in agronomic services, training and data management platforms.

This comes a year after respondents had abruptly cooled on these areas as points of emphasis within their business. After nearly doubling in 2014 from 31.1% to 54.1%, the percentage of dealers offering data management service continued to increase to 62.1% in 2015.

But last year, only 48.9% of respondents said they offer these services, and 33% said they didn’t. The numbers rebounded in 2017, with 56.7% of dealers saying they offer data management services, 26.9% saying they don’t and another 16.4% indicating they plan to add these services in the future.

“Analytics to bring all of this data together to mean something to the producer if it’s simple and intuitive is a focus,” says one precision dealer in Kansas. “We have to do more than make pretty maps to show the banker and landlord. We need to provide tools that will be used to lower cost and increase yield for our farm customers.”

How these analytical tools are being delivered by dealerships continues to be diverse, but there was a substantial increase in use of in-house agronomists. Some 42.2% of dealers who offer data management services report staff agronomists as their primary delivery method, more than double the 2016 total (20%) and ahead if the previous high of 36.5% in 2015.

Also increasing in popularity is partnering with local ag chemical firms for data management services, with 12.1% of dealers choosing this method in 2017, compared to 5.5% last year.

In-house agronomists and precision ag managers continue to be the most highly compensated precision staff members, but dealers are also paying entry level precision specialists a higher average salary.

While still the most popular approach for selling and supporting data management services, use of precision specialists to do so saw a double-digit decline, from a high of 81.8% in 2016, to 68.2% this year — the lowest total since 65.5% in 2013.

Despite the dip in precision specialists being the point people for delivery of data management services, dealerships are increasing their investment in agronomic training. Some 33.7% say they require agronomic training for their precision specialists, up from 22.8% in 2016.

Some dealerships are leveraging their in-house agronomists to be internal educators throughout the sales, service and parts departments to emphasize connection between farm equipment and the data being produced and collected on farms.

Notes one in-house agronomist at a large equipment dealership, “We’re trying to develop in-house agronomic training. The idea being if we can strengthen the relationship between the customer, their agronomist and us as a dealership, it really benefits everyone.”

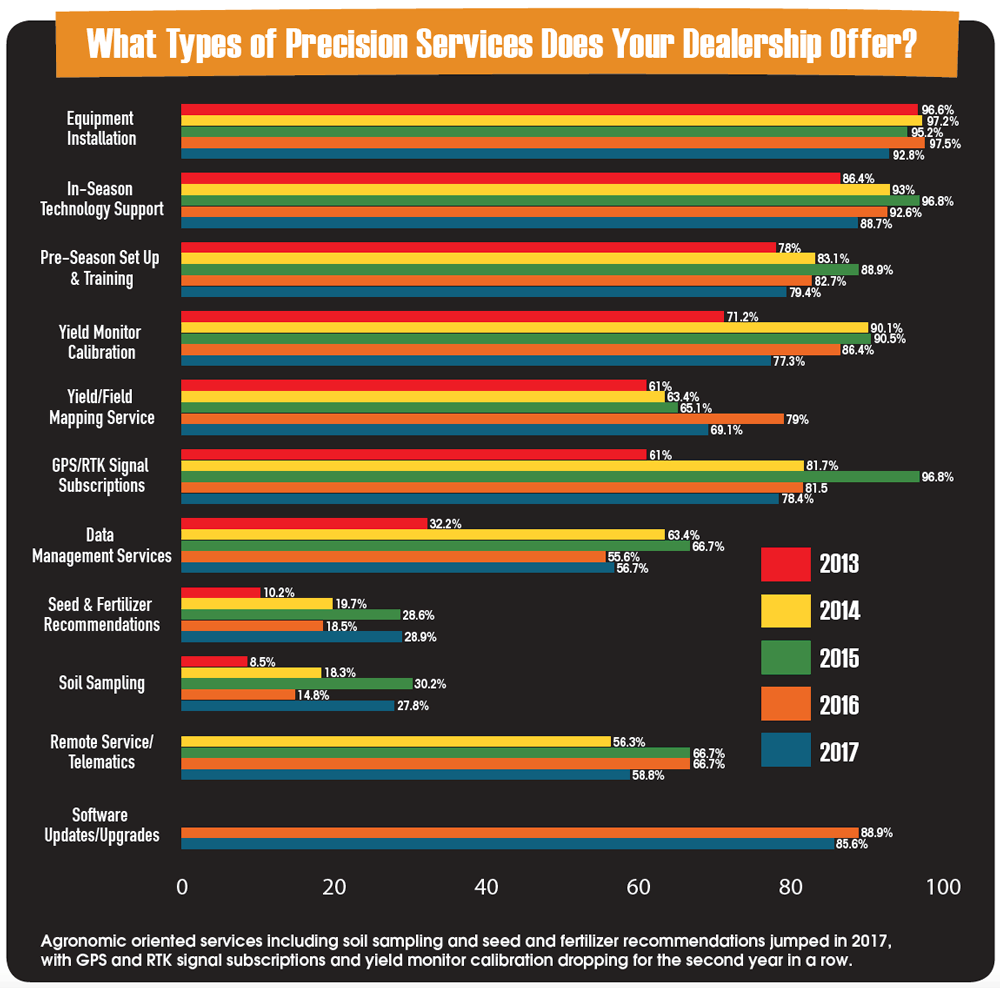

The rise dealers’ delivery of data management services also correlated to increases in agronomic-related services. Dealers offering seed and fertilizer recommendations jumped 10% year-over-year to an all-time high of 28.9% in 2017.

A bigger increase came in dealers offering soil sampling services, from 14.8% in 2016 to 27.8% this year. While not quite at the peak of 30.6% in 2015, the total is more than three-times as high as the 2013 total (8.5%).

But this year’s list of precision services also revealed some notable declines — especially for hardware-related offerings. For the second year in a row, dealers offering GPS and RTK signal subscriptions dropped to 78.4%, after peaking at 96.8% in 2015.

Also trending downward is dealers including yield monitor calibration service, with a low of 77.3% in 2017, after topping 85% each of the last 3 years. Other 2 year declines include pre-season setup and training and in-season technology support.

Overall, percentages in 8 of 11 service categories decreased year-over-year. It will be interesting to see if certain services continue to decline or simply fluctuate, depending on the market and customer adoption.

Earning Potential

Many dealers have packaged precision services for customers, either offering tiered annual plans or a selection of seasonal options with different price points.

However, for the first time since 2013, the percentage of dealers offering precision service packages to customers fell below 50% to 46.5% this year. This correlates to a dip in annual contracts being the preferred method for billing out services, from 23.5% last year to 13.1% in 2017.

Coming off a low of 67.9% last year, more dealers preferred an hourly rate (72.3%) for billing out precision service this year. However, this is well off the 85.5% average from 2013-15.

Nearly doubling year-over-year was the popularity of a per-acre fee for precision services, from 4.9% last year to 9.1% in 2017. This isn’t surprising, given the aforementioned increase in dealers offering agronomic services.

Dealers are also willing to pay for in-house agronomic expertise, with 21.6% offering salaries of at least $86,000 for this position, more than double the total from last year’s benchmark study. However, there was about a 20% drop in dealers paying staff agronomists $71,000-$85,000 year-over-year.

But more dealers also appear to be paying staff agronomists less in 2017, with 13.5% reporting in-house agronomist salaries of $25,000-$40,000, compared to only 5% in 2016.

Despite the compensation range, dealers tend to recommend investing in experience and quality when adding in-house agronomists.

“We didn’t know what we didn’t know, so to speak, and the first agronomist we hired had over 20 years of experience in the field,” says Craig Benedict, Integrated Solutions Manager with Reynolds Farm Equipment in Indiana. “This really helped our new program to take off. It also allowed us to implement a mentorship program so we could hire more young, inexperienced agronomists and train them under the leadership of our senior agronomist.”

While recruiting and retaining precision staff is a perennial challenge for dealers, they appear to be willing to pay more for supervisors. Some 82.6% of dealers pay precision farming managers at least $56,000 per year, well ahead of the 2016 total of 73.9%. This includes 20.3% providing salaries of at least $86,000.

Some 42.4% pay experienced precision specialists $41,000-$55,000 per year, about 8% off the 2016 total (50.8%), according to the study. About two-thirds of dealers (66.2%) compensate entry-level specialists with salaries of $25,000-$40,000, ahead of last year’s total (60.9%).

Departmental Shift

During the last several years, a growing majority of dealers have either established a separate department for precision farming or designated a precision farming specialist as the primary salesperson for ag technology.

This trend continues in 2017, with a few interesting developments. Some 60.8% of respondents have a dedicated precision farming salesperson, up slightly from 57.5% last year.

Also on the rise is use of a staff agronomist as the primary precision salesperson, from 2.3% last year to 7.2% this year. This would make sense, given the significant increase in dealers adding in-house agronomists.

After increases in 2016, fewer dealers are using the parts department (3.1%) and farm equipment salespeople (23.7%) to sell precision hardware and services in 2017, while use of the service department increased about 2% to 5.2%.

Allocation of precision staff also changed this year, continuing a shift away from personnel being part of sales, service and parts departments. Some 24.8% of precision staff are part of a dealership’s sales department, while 6.7% of precision staff are allocated to the parts department.

Both represent 5 year lows and continue 4 year declines in each category. The study also reveals fewer specialists being allocated to the service department, with a low of 18.1% this year, vs. 24.3% in 2016.

Those dealers operating a separate or independent precision department increased from 40.1% last year to 47.4% in 2017. While the trend is toward a more centralized structure with a precision farming business, dealers also acknowledge the need to integrate with other departments to capitalize on opportunities.

“We need to continue working on how we fit in with other departments and how to bill and organize sales that are packaged with iron sales,” says one dealer.

Looking Ahead

With 5 years of benchmark data to review, it’s interesting to evaluate the changes in dealers’ revenue projections for business growth. In 2013, GPS and guidance was far and away the category dealers saw the most money-making potential, with 91% identifying the area as “most important” or “important” to precision business growth.

Application technology and variable-rate systems topped the list, while GPS and guidance fell from second in 2016 to sixth this year.

While the category held the top position for 3 years, it ranked sixth among 10 opportunities for precision growth in 2017. Some 84.4% of respondents still view GPS and guidance as having revenue potential, but only 32.2% rated it as their “most important” area for precision growth during the next 5 years.

The overall slowdown in the ag market is certainly a contributing factor to the outlook, but it’s reasonable to believe that the abundance and diversity of products, along with dealers’ ongoing transition into more data-driven tools are having an impact as well.

That’s not to suggest dealers are abandoning hardware as potential sources of precision profit — it’s just taking different forms. Five years ago, 60.8% of dealers viewed variable-rate systems as an area of importance, ranking it eighth out of 10 categories. This year, the category ranked second, with 61.1% of respondents deeming it “most important” to grow revenue and another 34% viewing it as “somewhat important” to revenue growth.

A new question added to the benchmark study this year asked respondents to forecast the next “big leap” in precision farming technology, and several cited the advancement of variable-rate fertilizing and planting.

Says one dealer, “More precise placement and control of inputs will provide the most value for customers in the future.”

Consistently ranking high on the list of precision revenue priorities is application technology hardware. In 2013, it ranked second, with 85.5% of dealers viewing it as an important area to growing revenue. Little has changed in 5 years, as application technology tops the 2017 list, at 96.6%, with 52.2% of dealers identifying it as the “most important” area for precision revenue growth.

Similarly, planting and seeding controls have historically been viewed as a precision revenue priority. Starting in 2013, the category ranked third, with 76.9% indicating it as an area of importance. This year, the percentage is up to 94.4% — ranking it third — with 60% of dealers seeing it as “most important” to grow revenue.

Data management has fluctuated throughout the years in order of importance. But it’s clearly on the radar of more dealers today than in 2013 when 67.9% viewed it as important and it ranked seventh out of 10. This year, 86.7% view it as an important source of revenue in the next 5 years, placing it fourth on the list.

How dealers view future revenue opportunities may have shifted during the last 5 years, but their priorities for where they plan to invest in precision growth during the next 5 years largely remained the same, albeit with a few interesting changes.

Employee training topped the list in 2017, with for the first time, 100% of dealers viewing this area as a critical area of investment, including more than three-quarters (75.5%) who ranked it “most important.” This emphasis is consistent with dealers’ view 5 years ago, as employee training easily topped the list in 2013 (96.3%).

Customer training ranked a close second in 2017, with 98.9% of dealers targeting this as an area of importance during the next 5 years, including 52.2% who ranked this as “most important” — not far off the 2013 total of 48.2%.

Precision staff continues to be a priority as well, ranking third on the list in both 2017 (93.4%) and second in 2013 (91.2%). Says one dealer of the greatest challenge facing his precision business, “Employee advancement and turnover out of the department is a concern. Being able to get fresh employees up to speed and ahead of our early adopter customers is something we’re continuously working on.”

Rounding out the top four in 2017 is marketing (93.3%), including 41.6% viewing this as “most important,” again close to the 38.9% in 2013. At the 2017 Precision Farming Dealer Summit, Pete Youngblut, owner of Youngblut Ag, an independent precision dealer in Dysart, Iowa, said the first step in branding a dealership and the precision department is figuring out what you want to be in the marketplace.

“Your branding really starts with who are you?” Youngblut says. “I have a lot of customers who tell me ‘You have a great product. I really like my monitor, but I’m not buying a monitor, I’m buying you. I bought Pete, I paid for Pete.’”

Looking at dealers’ greatest needs to grow their precision business, this year’s responses continue the trend of prior years. For the second year in a row, customer training took the top spot, with 98.9% of respondents viewing this as the “most important” or “somewhat important” area of need.

Technician training was a close second, at 97.5%, with 58.9% of respondents ranking this as “most important,” tops on the list. These areas ranked second and third, respectively, in 2013 revealing an ongoing effort by dealers to satisfy these needs.

Customer training took the top spot again, while precision field days jumped to third, its highest placement ever on the list.

Five years ago, additional staff topped the list of dealer needs (88.9%), but tied for fourth in 2017 (83.3%) with beginning to bill for precision service. Interestingly, precision field days ranked third in 2017 (89.9%) — it’s highest placement ever — and well ahead of the 59.3% who viewed these events as priorities in 2013.

Rounding out the top five, was data management (83.1%), including 39.3% who identified this as “most important” ahead of 31.5% in 2013, when the category was last on the list.

Diverse Challenges

Last year, nearly one quarter of respondents cited low commodity prices as the biggest challenge they’ll face in the coming year. While fewer dealers cited this as a concern in 2017, as revenues showed signs of rebounding, the state of the ag economy continues to be a business growth barrier.

Says one dealer, “With the low commodity prices, customers are more reluctant to spend money. We have to come up with a good way to finance equipment and technology and not give away service.”

Still other dealers cited the need to develop more robust billable precision service programs and being more proactive with pre-season support. One dealer’s solution is to implement a more comprehensive tracking system for support tickets and sales quotes.

Perhaps a good problem noted by about a dozen respondents is the need to keep pace with customer demand, whether through a need for additional staff or staying ahead of the most progressive customers’ adoption curve.

But the most commonly noted challenge in this year’s benchmark study is being able to consistently and convincingly show return on investment to farm customers with more advanced ag technology. Getting customer “buy in” through demonstrations, training clinics and cross-training within dealerships are ways some dealers plan to approach this obstacle.

“Margins are continuing to shrink in the production ag economy,” says one Nebraska retailer. “We are addressing this through increased focus on ROI of precision technologies and increasing the collection of data illustrating this ROI.”

![[Technology Corner] Helping Your Customers Determine Which Technology is Right for Them](https://www.precisionfarmingdealer.com/ext/resources/2025/03/26/Helping-Your-Customers-Determine-Which-Technology-is-Right-for-Them.png?height=290&t=1743084621&width=400)