• Equipment net sales for second quarter climb 34% on strength in key markets.

• Conditions for agricultural and construction equipment show broad-based improvement.

• Company benefiting from positive customer response to innovative product lines.

MOLINE, Ill. (May 18, 2018) — Deere & Co. reported net income of $1.208 billion for the second quarter ended April 29, 2018 compared with net income of $808.5 million for the quarter ended April 30, 2017. For the first 6 months of the year, net income attributable to Deere & Co. was $673.2 million compared with $1.007 billion for the same period last year.

Worldwide net sales and revenues increased 29% to $10.720 billion, for the second quarter and rose 27% to $17.633 billion for 6 months. Net sales of the equipment operations were $9.747 billion for the second quarter and $15.721 billion for the first 6 months, compared with $7.260 billion and $11.958 billion for the periods last year.

John Deere reported another quarter of strong performance helped by a broad-based improvement in market conditions throughout the world and a favorable customer response to our lineup of innovative products,” said Samuel R. Allen, chairman and chief executive officer. “Farm machinery sales in both North and South America are making solid gains and construction equipment sales are continuing to move sharply higher. During the quarter, Deere made significant progress working with its suppliers to ramp up production and ensure that products reach customers in a timely manner. At the same time, we are experiencing higher raw material and freight costs, which are being addressed through a continued focus on structural cost reduction and future pricing actions.”

Summary of Operations

Net sales of the worldwide equipment operations increased 34% for the quarter and 31% for the first 6 months compared with the same periods a year ago. Deere’s acquisition of the Wirtgen Group (Wirtgen) in December 2017 added 12% to net sales for the quarter and 9% year-to-date. Sales included a favorable currency translation effect of 3% for both periods.

Equipment net sales in the U.S. and Canada increased 27% for the quarter and 26% year-to-date, with Wirtgen adding 5% and 3% for the respective periods. Outside the U.S. and Canada, net sales rose 45% for the quarter and 40% for the first 6 months, with Wirtgen adding 23% and 19% for the periods. Net sales included a favorable currency translation effect of 7% for the quarter and 6% for 6 months.

Deere’s equipment operations reported operating profit of $1.315 billion for the quarter and $1.734 billion for the first six months, compared with $1.120 billion and $1.375 billion, respectively, last year.

Excluding Wirtgen results, the improvement for both periods was primarily driven by higher shipment volumes and lower warranty costs, partially offset by higher research and development expenses and higher production costs. The corresponding periods of 2017 included a gain on the sale of SiteOne Landscapes Supply Inc. (SiteOne).

Additionally, in the first 6 months of last year Deere incurred expenses associated with a voluntary employee-separation program.

Net income of the company’s equipment operations was $1.103 billion for the second quarter and $139 million for the first 6 months, compared with net income of $700 million and $785 million for the same periods of 2017. In addition, the quarter was favorably affected by $207 million and the 6 month period unfavorably affected by $1.032 billion due to provisional income tax adjustments related to tax reform.

Financial services reported net income attributable to Deere & Co. of $104.1 million for the quarter and $529.4 million for the first 6 months compared with $103.5 million and $217.9 million last year. Results for both periods benefited from a higher average portfolio, lower losses on lease residual values, and a lower provision for credit losses, partially offset by a less favorable financing spread. Additionally, provisional income tax adjustments related to tax reform had an unfavorable effect of $33.2 million for the quarter and a favorable effect of $228.8 million for 6 months.

Company Outlook & Summary

Company equipment sales are projected to increase by about 30% for fiscal 2018 and by about 35% for the third quarter compared with the same periods of 2017.

Net sales and revenues are expected to increase by about 26% for fiscal 2018 with net income attributable to Deere & Co. forecast to be about $2.3 billion. The company’s net income forecast includes $803 million of provisional income tax expense associated with tax reform, representing discrete items for the remeasurement of the company’s net deferred tax assets to the new U.S. corporate tax rate and a one-time deemed earnings repatriation tax. Adjusted net income attributable to Deere & Co. excluding the provisional income tax adjustments associated with tax reform is forecast to be about $3.1 billion.

The current outlook for net income compares with previous guidance of $2.1 billion, which included $977 million of provisional income tax expense. “We are encouraged by strengthening demand for our products and believe Deere is well positioned to capitalize on further growth in the world’s agricultural and construction equipment markets,” Allen said. “This illustrates our success developing a more durable business model as well as the impact of investments in new products and businesses. We reaffirm our confidence in the company’s present direction and our belief that Deere remains on track to deliver significant long-term value to customers and investors.”

Equipment Division Performance

Agriculture & Turf. Sales rose 22% for the quarter and 20% for the first 6 months due to higher shipment volumes and the favorable effects of currency translation. Operating profit was $1.056 billion for the quarter and $1.443 billion year to date, compared with respective totals of $1.009 billion and $1.227 billion for the same periods last year. Results for the quarter were helped by higher shipment volumes, partially offset by higher research and development expenses and production costs. For the first 6 months, results benefited from higher shipment volumes and lower warranty-related expenses, partially offset by higher research and development expenses and production costs. Prior-year periods benefited from gains on the SiteOne sale, while the first 6 months of last year were affected by voluntary employee-separation expenses.

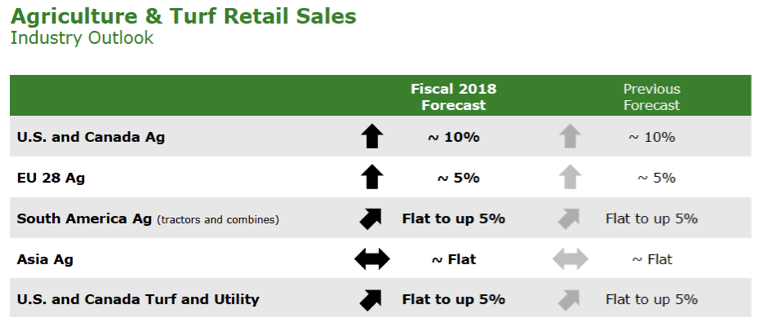

Source: Deere & Co. forecast as of 18 May 2018.

Construction & Forestry. Construction and forestry sales increased 84% for the quarter and 73% for 6 months, with Wirtgen adding 60%t and 44% for the respective periods. Also helping sales for both periods were higher shipment volumes and the favorable effects of currency translation.

Operating profit was $259 million for the quarter and $291 million for six months, compared with $111 million and $148 million last year. Wirtgen contributed operating profit of $41 million for the quarter and a six-month operating loss of $51 million related to the effects of purchase accounting and acquisition costs. Excluding Wirtgen, the improvements were primarily driven by higher shipment volumes and lower warranty expenses, partially offset by higher production costs. Results for the first 6 months of last year also included voluntary employee-separation costs.

Market Conditions & Outlook

Agriculture & Turf. Deere’s worldwide sales of agriculture and turf equipment are forecast to increase by about 14% for fiscal year 2018, including a positive currency translation effect of about 1%. Industry sales for agricultural equipment in the U.S. and Canada are forecast to be up about 10% for 2018, led by higher demand for large equipment. Full-year industry sales in the EU28 member nations are forecast to be up about 5% due to favorable conditions in the dairy and livestock sectors. South American industry sales of tractors and combines are projected to be flat to up 5% benefiting from strength in Brazil. Asian sales are forecast to be in line with last year. Industry sales of turf and utility equipment in the U.S. and Canada are expected to be flat to up 5% for 2018.

Construction & Forestry.

Deere’s worldwide sales of construction and forestry equipment are anticipated to be up about 83% for 2018, including a positive currency-translation effect of about 1%. Wirtgen is expected to add about 56% to the division’s sales for the year. The outlook reflects continued improvement in demand driven by higher housing starts in the U.S., increased activity in the oil and gas sector, and economic growth worldwide. In forestry, global industry sales are expected to be up about 10% mainly as a result of improved demand throughout the world, led by NorthAmerica.

Financial Services.

Fiscal-year 2018 net income attributable to Deere & Company for the financial services operations is projected to be approximately $800 million, including a provisional income tax benefit of $229 million associated with tax reform. Forecasted fiscal-year 2018 adjusted net income attributable to Deere & Company excluding the provisional income tax benefit is projected to be $571 million. Results are expected to benefit from a higher average portfolio and lower losses on lease residual values, partially offset by less-favorable financing spreads and increased selling, administrative and general expenses. The financial services net income outlook provided last quarter was $840 million. It included a provisional tax benefit estimate of $262 million for remeasurement of the division’s net deferred tax liability to the new U.S. corporate tax rate and a one-time deemed earnings repatriation tax.

John Deere Capital Corp.

The following is disclosed on behalf of the company's financial services subsidiary, John Deere Capital Corp. (JDCC), in connection with the disclosure requirements applicable to its periodic issuance of debt securities in the public market.

Net income attributable to JDCC was $119.2 million for the second quarter and $518.6 million year to date, compared with $64.5 million and $138.7 million for the respective periods last year. Results for both periods benefited from a favorable provision for income taxes associated with tax reform, a higher average portfolio, lower losses on lease residual values and lower provision for credit losses, partially offset by less-favorable financing spreads. Net receivables and leases financed by JDCC were $34.535 billion at April 29, 2018, compared with $32.015 billion at April 30, 2017.

![[Technology Corner] Discussing AI’s Potential Impact on Service & Support](https://www.precisionfarmingdealer.com/ext/resources/2025/04/11/Discussing-AIs-Potential-Impact-on-Service--Support.png?height=290&t=1744385717&width=400)