SIOUX FALLS, S.D., — Raven Industries Inc. reported financial results for the first quarter that ended April 30, 2018.

Noteworthy Items:

- Consolidated net sales increased 19% year-over-year and all three divisions increased division profit margin year-over-year;

- Launched Applied Technology's new Latin American headquarters in Brazil, aggressively pursuing organic growth opportunities in this key region;

- Applied Technology sustained the strong sales performance achieved in the prior year despite persistently low commodity prices and increased division profit margin;

- Engineered Films' strong financial performance continued with organic growth and profit margin expansion;

- Aerostar doubled division operating income year-over-year, from $1.4 million to $2.8 benefiting from a narrowed focus and generating higher sales;

- Recognized a $5.8 million non-operating gain on the sale of the Company's ownership interest in Site-Specific Technology Development Group, Inc. (SST);

- Commitment to support South Dakota State University with a financial gift for the expansion of its precision agriculture program and the establishment of a new precision agriculture facility resulted in a $4.5 million operating expense during the first quarter.

First Quarter Results:

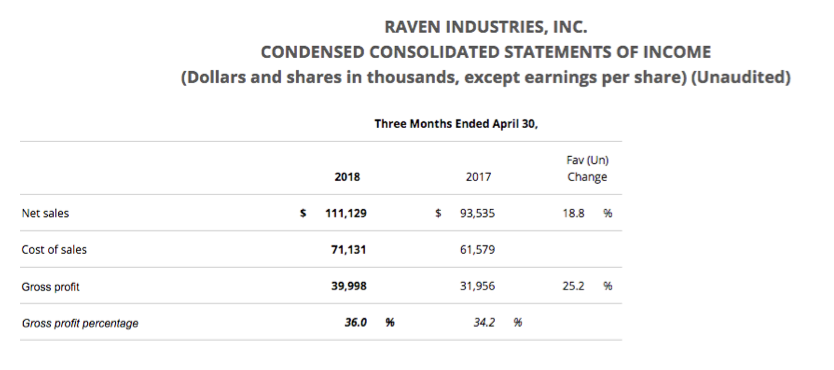

Net sales for the first quarter of fiscal 2019 were $111.1 million, up 18.8% vs. the first quarter of fiscal 2018. Engineered Films and Aerostar achieved double-digit growth in sales year-over-year during the first quarter, and Applied Technology sustained the strong growth achieved in the prior year. Delivery of hurricane recovery film contributed sales of $8.9 million during this year's first quarter.

Operating income for the first quarter of fiscal 2019 was $21.5 million vs. operating income of $18.2 million in the first quarter of fiscal 2018, increasing 18.2% year-over-year on a reported basis. All three divisions achieved growth year-over-year in operating income during the first quarter. Included in this year's first quarter operating income was an expense of $4.5 million related to the previously announced gift to South Dakota State University and $900,000 of expenses related to Project Atlas. Excluding these items, operating income increased significantly more than reported results year-over-year.

Net income for the first quarter of fiscal 2019 was $22.1 million, or $0.61 per diluted share, vs. net income of $12.3 million, or $0.34 per diluted share, in last year's first quarter. Included in this year's first quarter results on a pre-tax basis were: a non-operating gain on the sale of the Company's ownership interest in SST of $5.8 million ($4.7 million after-tax, or $0.13 per diluted share); an expense associated with the previously announced gift to South Dakota State University of $4.5 million ($3.7 million after-tax, or $0.10 per diluted share); and Project Atlas related expenses of $0.9 million ($0.7 million after-tax, or $0.02 per diluted share). Additionally, the 12.8 percentage point reduction in the company's effective tax rate year-over-year resulted in a tax benefit relative to the prior year of $3.5 million.

Applied Technology Division:

Raven’s agricultural segment is included in its Applied Technology Division. Net sales for Applied Technology in the first quarter of fiscal 2019 were $40.4 million, essentially flat vs. the first quarter of fiscal 2018. The division sustained the strong growth achieved in the prior year despite persistently low commodity prices. Geographically, domestic sales were down 2.4k precet year-over-year, while international sales were up 6.6 percent year-over-year.

Division operating income in the first quarter of fiscal 2019 was $15.9 million, up $2.5 million or 18.5% vs. the first quarter of fiscal 2018. Division operating margin increased 620 basis points year-over-year, driven mostly by lower warranty expense and favorable legal recoveries.

Fiscal 2019 Outlook:

“All three divisions continued to achieve strong operating results during the first quarter of fiscal 2019,” said Dan Rykhus, president and CEO. “Investments in growth are leading to increased demand, and operational execution is resulting in higher sales volume and improved financial performance.

“Applied Technology continues to drive results through innovation and investments to grow internationally. During the quarter, the division established its new Latin American headquarters in Brazil to drive sales in this key geographic market.

“Engineered Films continued to achieve expected sales growth and profitability. The division is leveraging past investments to capitalize on strategic opportunities and is investing in additional capabilities to capture increased demand from existing customers. The underlying fundamentals remain strong and the division's operational execution is delivering impressive financial results.

“Aerostar's financial performance progressed in the first quarter of fiscal 2019. Confidence is strong within the division and Aerostar further sharpened its focus as evidenced by the divestiture of its client private business during the quarter. Stratospheric balloon systems continue to build positive momentum and achieve key milestones.

“The Company is off to a strong start to the year. Underlying organic growth in consolidated net sales and operating income were approximately 5% and 20%, respectively, when excluding unusual items. Each of the divisions is well positioned in its markets and we expect our positive momentum to continue," concluded Rykhus.

About Raven Industries, Inc.:

Raven Industries (NASDAQ:RAVN) is dedicated to providing innovative, high-value products and solutions that solve great challenges throughout the world. Raven is a leader in precision agriculture, high-performance specialty films, and lighter-than-air technologies. Since 1956, Raven has designed, produced, and delivered exceptional solutions, earning the company a reputation for innovation, product quality, high performance, and unmatched service. For more information, visit http://ravenind.com.

![[Technology Corner] Helping Your Customers Determine Which Technology is Right for Them](https://www.precisionfarmingdealer.com/ext/resources/2025/03/26/Helping-Your-Customers-Determine-Which-Technology-is-Right-for-Them.png?height=290&t=1743084621&width=400)