The results of the eighth annual Precision Farming Dealer benchmark study — with contributions from dozens of farm equipment dealers, input retailers and independent precision companies — trend toward a conservative reality and a cautious outlook for the majority of respondents.

The 2020 data — collected during the first and second quarters — reflect the influence of an inconsistent ag economy, further complicated by the impact of global coronavirus pandemic on dealerships’ precision revenue.

Still, precision dealers generally maintained a positive financial forecast, tempered somewhat by adjusted expectations and shifting sales and service priorities.

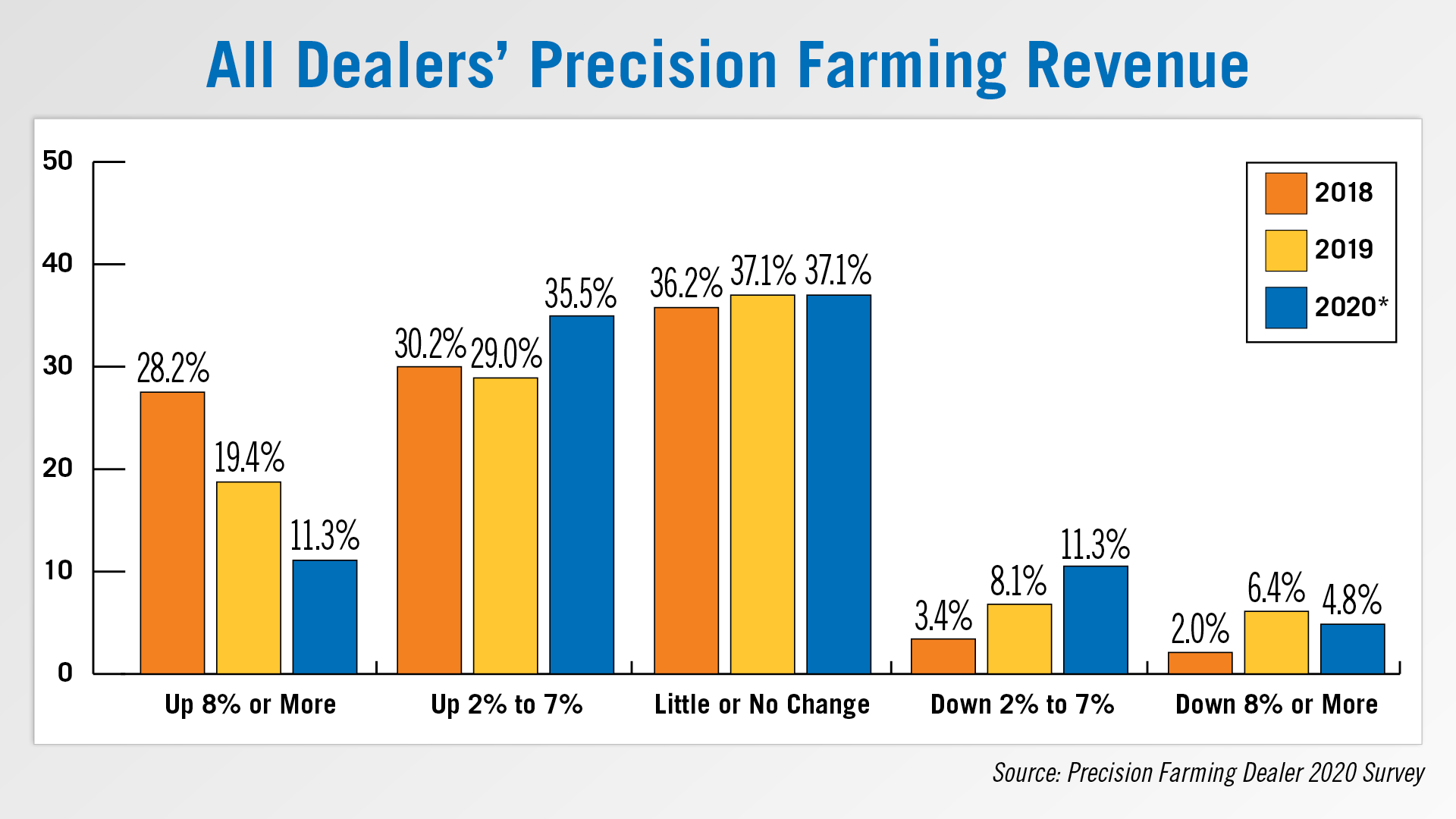

Comparing responses gathered from 24 different states, Canada and overseas, about 19% of dealers reported precision revenue growth of 8% or more in 2019, nearly on par with the 20% who forecasted this level in last year’s report.

While close to meeting projections, 2019 marked the first time in 5 years that dealers didn’t exceed their higher-end revenue expectations. In last year’s report, 28% of dealers reported precision revenue growth of 8% or more in 2018, slightly ahead of the 26% forecasted.

So what are dealers expecting this year? Overall, some 48% forecast revenue growth of at least 2% over 2019, with about 11% projecting growth of at least 8%.

This continues an increasingly conservative revenue outlook going back the last 3 years. Some 37% of dealers expect little or no change in 2020 revenue, while about 16% forecast revenue declines of at least 2% — the highest total in the history of the benchmark study.

You can find the complete 2020 benchmark study report and analysis coming in the Summer issue of Precision Farming Dealer and extended coverage of past studies at PrecisionFarmingDealer.com.

![[Technology Corner] Deere Upgrades Allow Farmers to Take Smaller Steps with Precision Tech](https://www.precisionfarmingdealer.com/ext/resources/2025/03/13/Deere-Upgrades-Allow-Farmers-to-Take-Smaller-Steps-with-Precision-Tech.png?height=290&t=1741960939&width=400)