Problem solving is often the linchpin of a dealership’s precision farming business. The last couple of years have tested the abilities of precision teams to overcome ongoing economic — and more recently — social challenges to maintain, if not grow revenue.

The results of the eighth annual Precision Farming Dealer benchmark study — with contributions from dozens of farm equipment dealers, input retailers and independent precision companies — trend toward a conservative reality and a cautious outlook for the majority of respondents.

The 2020 data — collected during the first and second quarters — reflect the influence of an inconsistent ag economy, further complicated by the impact of the global coronavirus pandemic on dealerships’ precision revenue.

Still, precision dealers generally maintained a positive financial forecast, tempered somewhat by adjusted expectations and shifting sales and service priorities.

Says one major line precision dealer from Wisconsin, “After COVID-19 and what that will bring, the next biggest challenge will be keeping a remote staff engaged as we transition from a department that ‘does’ to a department that ‘supports others in doing.’ We can’t continue to support the legacy equipment and learn everything there is to know about new equipment.

“However, many of the best on my team are ‘learn then do’ people, not teachers, but I need them to be as excited to teach as they were to learn.”

Stability in Uncertainty

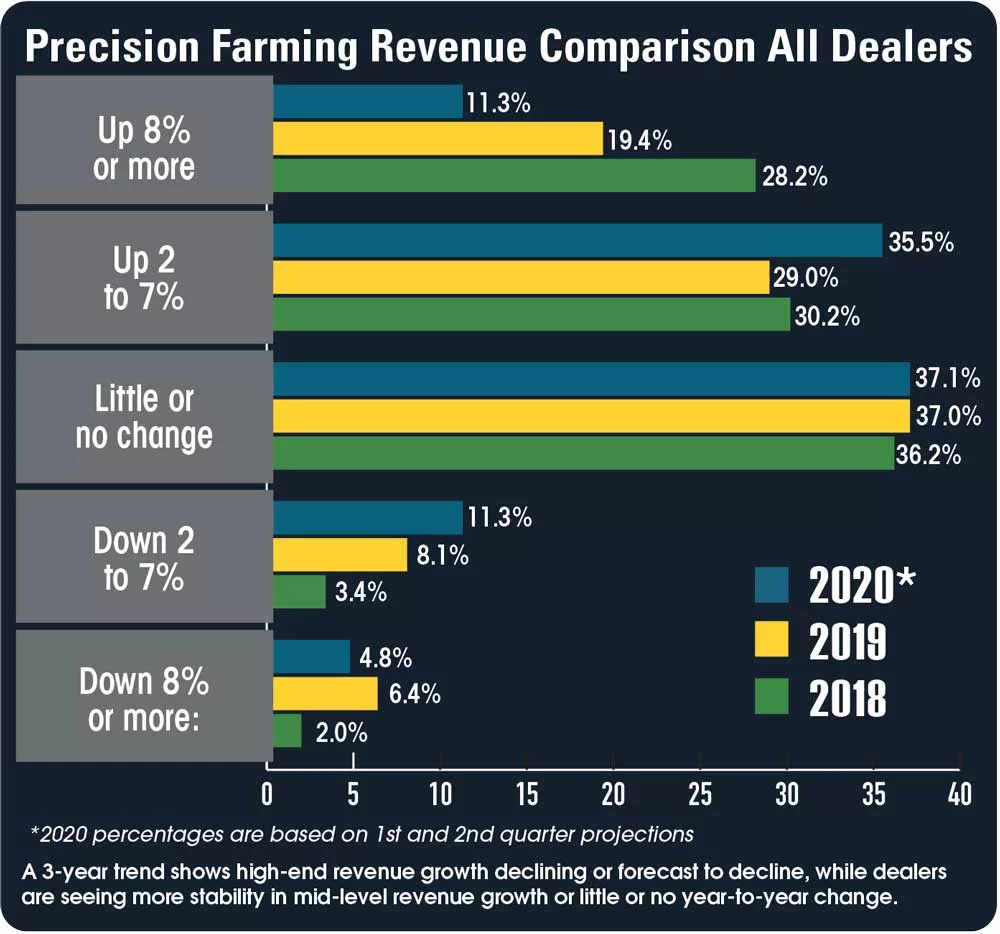

Comparing responses gathered from 24 different states, Canada and overseas, about 19% of dealers reported precision revenue growth of 8% or more in 2019, nearly on par with the 20% who forecasted this level in last year’s report.

While close to meeting projections, 2019 marked the first time in 5 years that dealers didn’t exceed their higher-end revenue expectations. In last year’s report, 28% of dealers reported precision revenue growth of 8% or more in 2018, slightly ahead of the 26% forecasted.

Some 31.5% of dealers reported precision revenue growth of 8% or more in 2017, more than double the forecast (15.4%), and in 2016, about 23% of dealers reported precision revenue growth of 8% or more, more than doubling that year’s forecast (10%).

Continuing a 3-year trend, mid-range precision revenue growth slowed in 2019. Some 29% of respondents reported precision revenue growth of 2-7% in 2019, which tracked about 7 points behind last year’s forecast.

2018 revenue in the 2-7% range was about 10% off of initial projections (40.8%) with 30.2% of dealers reporting modest precision revenue growth. Dealers also fell short of more modest revenue projections in 2017. About 44% forecasted growth of 2-7%, but 2018 data showed that only about 25% achieved that goal.

About 37% reported little or no change to 2019 precision revenue totals, compared to the 2018 total of 36%.

The most significant change came in the reported revenue declines in 2019, compared to initial projections. More than 14% of respondents to the 2020 benchmark study indicated at least a 2% decline in 2019 precision revenue, about double the forecast from that year’s report.

While a measurable change in the 5.4% of respondents who reported a decline in revenue of 2% or more in 2018, in 2017, about 13% reported precision revenue declines of at least 2%, and in 2016, about 23% reported a dip of at least 2%, including nearly 9% that saw a decline of 8% or more.

Farm Equipment Dealers. A further breakdown of 2019 revenue showed that the majority of farm equipment dealers went into the year with high revenue hopes. About 60% projected precision growth of at least 2% in 2019, including 17% who forecasted growth of 8% or more.

But the 2020 benchmark study showed that only about 48% of farm equipment dealers achieved at least 2% growth in their precision farming business in 2019. Only 3% had initially forecast a decline of at least 2% in 2019 precision revenue, but data from this year’s study shows that nearly 15% reported at least a 2% decline in precision revenue last year.

Putting the 2019 totals in historical perspective, the year-to-year changes aren’t as dramatic and could reflect a market adjustment after several years of dealers exceeding higher-end precision revenue projections.

Adjusted Expectations

So what are dealers expecting this year? Overall, some 48% forecast revenue growth of at least 2% over 2019, with about 11% projecting growth of at least 8%.

This continues an increasingly conservative revenue outlook going back the last 3 years. Some 37% of dealers expect little or no change in 2020 revenue, while about 16% forecast revenue declines of at least 2% — the highest total in the history of the benchmark study.

However, some dealers reported strong starts to 2020. Layne Richins, precision ag manager with Stotz Equipment, a 25-store John Deere dealership, noted this spring that the dealership was about 25% ahead on

precision sales.

Other dealers have pointed to renewed emphasis and opportunity with remote service in the age of social distancing and the value of diagnosing technical problems without having to physically be on a customer’s farm.

Arlin Sorensen, founder HTS Ag, an independent precision farming dealership in Harlan, Iowa, suggests aspects of how dealerships do business and operate will be forever changed — in some cases for the better — as a result of their experience adapting to COVID-19.

“Change is going to be survival,” he says. “Two months ago, how many companies would have never thought they’d be able to run an efficient business with employees working from home? Today, they’re seeing that it can run pretty well and I think even within dealerships, we’ll see some rethinking of workforces and how services are delivered and where they are delivered from.”

Farm Equipment Dealer Outlook. Consistent with the broader dealership revenue outlook for 2020, some 46% of farm equipment dealers forecast revenue growth of at least 2%, including 11% projecting an increase of 8% or more.

About 40% expect little or no change this year, while more than 12% forecast a revenue decline of at least 2% in 2020.

Precision Outlook: Dealers Shift Focus to Application Hardware, Maintain Need for Training

![[Technology Corner] A Big Step Forward for Interoperability & Data Sharing](https://www.precisionfarmingdealer.com/ext/resources/2025/12/12/A-Big-Step-Forward-for-Interoperability--Data-Sharing.webp?height=290&t=1765565632&width=400)