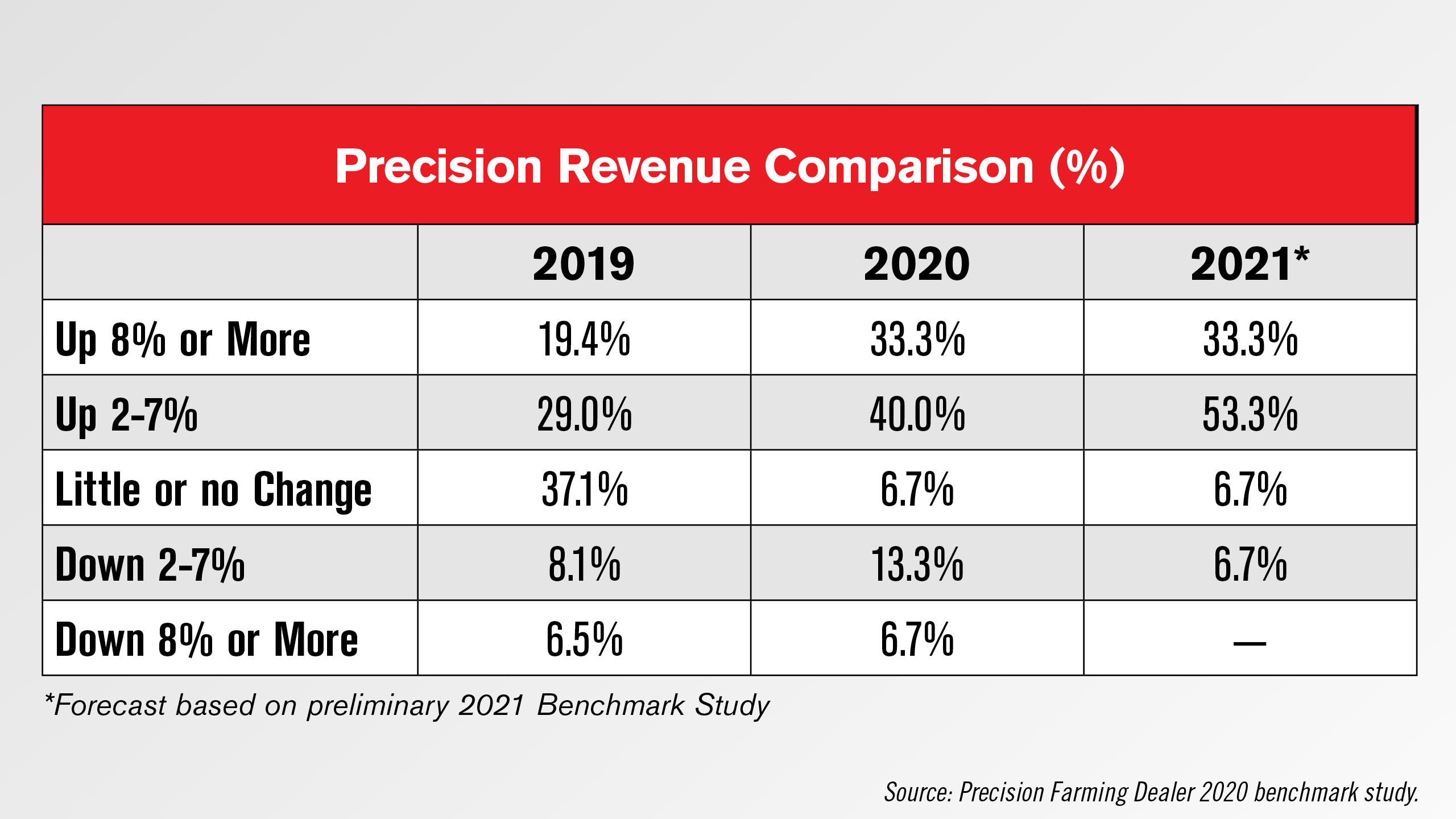

Precision specialists are no strangers to being called upon to consistently meet, and exceed performance expectations. The trait translated to dealerships eclipsing 2020 revenue expectations reported in last year’s Precision Farming Dealer benchmark study.

Some 46% of participating dealers forecast revenue growth of at least 2%, with about 11% projecting growth of at least 8%. But preliminary data from the 9th annual Benchmark Study shows that 73% of responding dealers increased precision revenue by at least 2%, including one-third that increased revenue by more than 8% in 2020.

With contributions from farm equipment dealers, input retailers and independent precision companies of all sizes and equipment colors, the initial data points to a more confident outlook for 2021.

Some 86% of dealers project at least a 2% increase in precision revenue this year — a high in the 9-year history of the benchmark study. This includes one third of dealers forecasting more than an 8% increase in precision revenue.

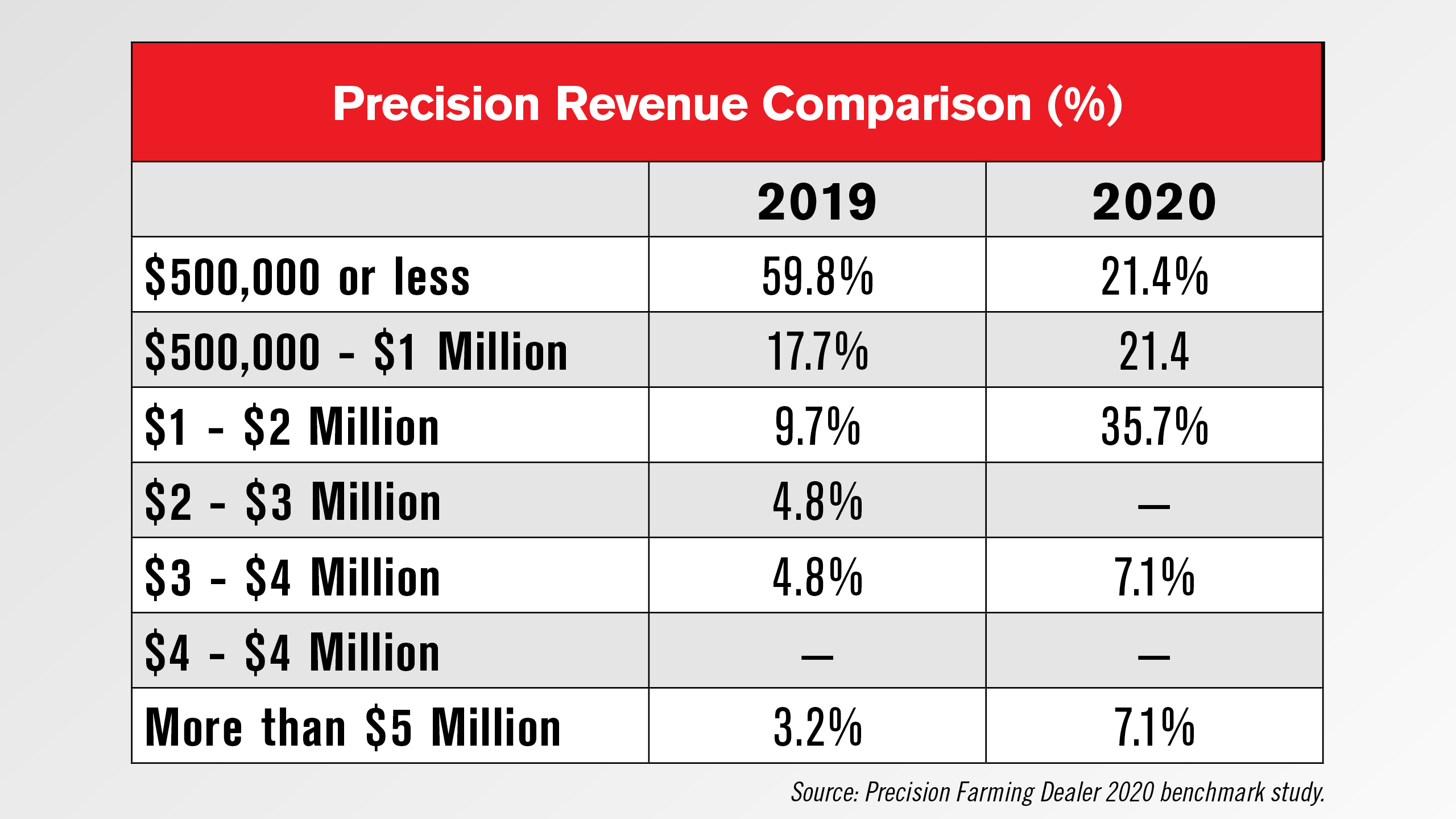

The more optimistic outlook is bolstered by an increase in estimated year-over-year precision farming revenue. Nearly 60% of dealers reported precision revenue of $500,000 or less in 2019, compared to just over 21% in 2020.

Nearly 50% of dealers reported 2020 revenue of at least $1 million, compared to about 37% in 2019.

Look for complete coverage of the 2021 benchmark study and analysis coming in the Summer issue of Precision Farming Dealer and extended coverage of past studies here.

![[Technology Corner] Helping Your Customers Determine Which Technology is Right for Them](https://www.precisionfarmingdealer.com/ext/resources/2025/03/26/Helping-Your-Customers-Determine-Which-Technology-is-Right-for-Them.png?height=290&t=1743084621&width=400)