Supply chain shortages have some dealers digging out decades-old precision equipment to help their customers get crops off the fields.

An industry-wide shortage of the GPS receivers used to run tractor guidance and data systems is leaving dealers — and farmers — without the equipment needed to record digital harvest maps. To fill in the gap during the busy September-November harvest season, Deere dealer Ag-Pro is putting GPS units from 2004 back to work.

Ag-Pro Utilizes John Deere StarFire iTC Receivers to Fill Gaps

Alex Kutz, integrated solutions consultant for Ag-Pro Ohio, is one of five employees who helps precision customers at Ag-Pro’s 28 Ohio and Kentucky stores.

He said all of the company’s 78 stores are offering John Deere Starfire iTC receivers, one of Deere’s earliest GPS receivers, to customers waiting for the new StarFire 6000 units. Other Deere dealers across the U.S. are doing the same.

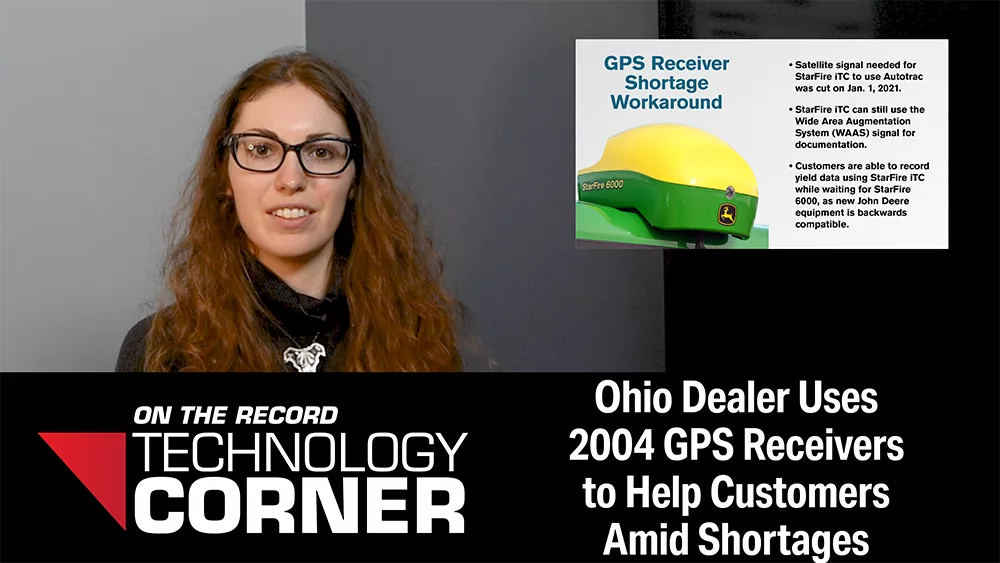

As of Jan. 1, 2021, iTC receivers can’t receive the satellite signal needed for Autotrac, making them useless — up until recently.

The receivers can still use the Wide Area Augmentation System, known as WAAS, signal, so they’re able to document yield data. Deere also came out with an update a couple months ago to make the documentation signals more accurate and reliable in the field.

The new Deere equipment is backward compatible, so Kutz says it takes next to nothing to get a customer up and running with the old receivers.

“The guys that just want to do the documentation, they're pretty happy about that because it is a lot cheaper than buying a whole new receiver,” Kutz says. “Some of them are bummed out that they can't run the autosteer system. But this is something that we've got to work through, and fortunately, our customers have been very understanding.”

Chip Shortage Affects Precision Agriculture Companies

The lack of GPS receivers is a result of the worldwide semiconductor chip shortage. As factories and ports shut down in 2020 due to the COVID-19 pandemic, production slowed and bottlenecks ensued. The shortage has impacted technology companies across industries, including agriculture.

Andreas Reichhardt, founder of Reichhardt Electronic Innovations, says the company has felt the impact of the chip shortage in the last 6-7 months. The lead time on chips is more than 50 weeks and still unstable, according to Reichhardt. He hopes the market will start to improve by the end of spring of 2022. In the meantime, he’s leveraging his supplier relationships to meet dealers’ and customers’ demands.

“We have to openly discuss our situations quite often,” Reichhardt says. “There are always chances to find a different solution. We can maybe move material from A to B. We can exchange things — a shortage here is an overstock here — things like that. But the first thing is to keep close contact with the farmers and dealers, and frequently discuss the situation.”

The procurement and ops teams at precision technology company Trimble have also been taking action to mitigate the shortage. Guillermo Perez-Iturbe, director of marketing at Trimble, says it’s difficult to guess when the shortage will end, as conditions and predictions change day-to-day.

“It's a challenging time, absolutely,” Perez-Iturbe says. “We all are experiencing that. Nonetheless, we never stopped shipping equipment, and we never closed our doors. We never stopped taking orders. We've always been very practical and working with our partners to keep delivering a high level of simple and compatible technology to the market.”

Share how your dealership is balancing customer needs with supply shortages by emailing [email protected] or answering this Precision Farming Dealer poll.

![[Technology Corner] A Big Step Forward for Interoperability & Data Sharing](https://www.precisionfarmingdealer.com/ext/resources/2025/12/12/A-Big-Step-Forward-for-Interoperability--Data-Sharing.webp?height=290&t=1765565632&width=400)