Articles by Jack Zemlicka

2019 BENCHMARK STUDY

Part 3: Putting Agronomic Emphasis on Service Revenue & Customer Retention

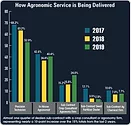

In-house agronomists and annual service contracts see jumps in 2019, while fewer rely on precision specialists for delivery of data management support.

Read More

2019 BENCHMARK STUDY

Part 2: Mix & Match Approach with Precision Products, Services Sets Up Comprehensive Sales

Hardware sales rebounded, independent sales revenue dipped and fewer dealers have a separate department for precision farming.

Read More

2019 BENCHMARK STUDY

Part 1: Dealers Again Exceed High-End Precision Revenue Projections

Despite market challenges, a majority of dealers report measurable precision revenue growth in 2018, including nearly one-third seeing an increase of at least 8%.

Read More

![[Technology Corner] A Big Step Forward for Interoperability & Data Sharing](https://www.precisionfarmingdealer.com/ext/resources/2025/12/12/A-Big-Step-Forward-for-Interoperability--Data-Sharing.webp?height=290&t=1765565632&width=400)